Costing in Garment Industry – How Buyers and Factories Calculate Pricing Effectively

Costing in garment industry is the backbone of every pricing decision made between apparel buyers and factories. Whether it’s a global fashion brand planning its next seasonal collection or a small manufacturing unit quoting prices for private label clients, an accurate costing sheet can determine profitability, competitiveness, and sustainability. It isn’t just a list of numbers, it’s a strategic tool that can influence buyer confidence and supplier margins.

At its core, garment costing answers the question: what does it really take to produce this piece of clothing? From fabric selection and labor wages to machine depreciation and shipping costs, every detail matters. Buyers rely on costing sheets to evaluate price fairness, while factories use them to justify rates and defend profit margins. When both sides understand the variables, negotiations become easier, faster, and more transparent.

But here’s the tricky part: garment costing isn’t universal. It varies based on region, product type, production scale, and even seasonal demand. That’s why knowing the structure, terms, and logic behind a costing sheet is essential, not just for finance teams but also for designers, merchandisers, and sales reps. Whether you’re trying to optimize your sourcing strategy or looking to improve internal cost control, this deep dive into the costing in garment industry will walk you through every key component that shapes apparel prices.

Basics of Costing in Garment Industry and Cost Sheet Breakdown

What Is a Garment Costing Sheet in the Garment Industry?

The garment costing sheet is more than just an internal factory document, it’s a shared language between manufacturers and global buyers. In the costing in garment industry, this sheet summarizes every cost input needed to manufacture a product. From raw fabric to the final packed item, it captures all financial touchpoints and makes them visible.

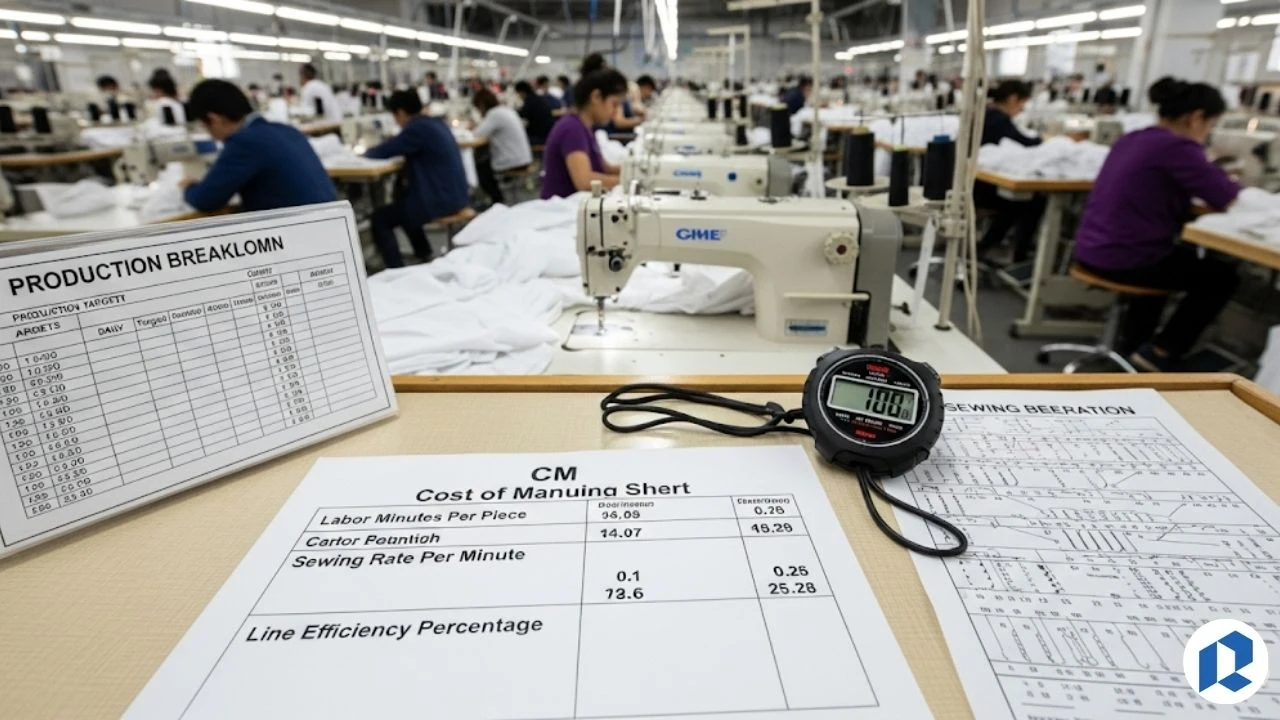

Typically, a cost sheet for garment begins with a style number or reference, followed by breakdowns like fabric, trims, cut-make (CM), packaging, washing, printing, testing, and overhead allocations. Additional details like quantity, shipment date, buyer info, and terms (like FOB or CIF) are also included.

Now, why does this matter? Because every buyer wants transparency, and every supplier wants justification. When a garment costing sheet is well-documented, it prevents miscommunication. Buyers can question fabric rates, negotiate CM charges, or ask why polybags are expensive, all based on this sheet.

For factories, the cost sheet garment ensures they don’t quote blindly. It protects them from underpricing due to missing hidden costs like compliance testing or sample courier fees. Over time, it becomes a database of past styles, pricing patterns, and even margin trends.

The costing in garment industry relies heavily on these documents during sampling, negotiation, and order finalization. So, if you’re not already building them with accuracy, now is the time to start.

Components of a Fashion Design Garment Cost Sheet

Designers and merchandisers often work in sync with finance teams when it comes to creating a fashion design garment cost sheet. This document must reflect not just numbers, but also creativity, brand positioning, and functionality. Unlike standard pricing tools, it aligns aesthetic goals with commercial reality.

Start with apparel costing for core elements like fabric. Depending on the garment type (formalwear, streetwear, activewear), fabric percentage can range from 40% to 70% of the total cost. Next, you have trims, zippers, buttons, labels, thread, each adding a marginal but essential cost.

Then comes construction. Certain designs might demand more skilled labor or advanced machinery, which gets reflected in the CM charges. Complex prints, dyeing techniques, or sustainable processing also elevate the numbers.

The fashion design garment cost sheet doesn’t just stop at materials. It includes packaging, hangtags, folding style, polybags, barcodes, and shipping carton specs. All of these affect both presentation and price.

Some factories also attach a price sheet separately that includes markup and taxes, giving buyers clarity on the total commercial rate. While apparel costing focuses on internal expenditure, the price sheet focuses on selling price per piece, an important distinction.

Ultimately, this sheet is what bridges the creative ambitions of a designer with the financial realities of manufacturing. Get this part right, and you’re not only producing beautiful clothes, you’re pricing them right for the market.

Costing in Garment Industry: Direct and Indirect Cost Explained

One of the most common points of confusion in the costing in garment industry is understanding direct and indirect costs. Yet this is where profit margins are often made, or lost. Let’s clear it up.

Direct costs are those that can be directly traced to the product. In garment manufacturing, this includes fabric, trims, packaging, thread, and sewing wages. These are per-unit costs and vary based on garment type, fabric composition, and order quantity.

Indirect costs, on the other hand, are not traceable to a single unit. These include electricity, rent, managerial salaries, software tools, depreciation, and compliance certifications. You can’t say how much electricity was used to produce one t-shirt, but you can allocate a portion of the monthly power bill across total units produced.

Many companies struggle to classify borderline items. For example, fabric wastage during cutting, is that direct or indirect? It depends on how it’s recorded. What about a sample courier charge for a buyer in Germany? That’s an indirect, semi-variable cost.

The costing in garment industry must be clear and logical about this split. Misclassification leads to skewed pricing. If indirect costs aren’t properly allocated, you might underquote and face losses. If you overestimate, your price becomes uncompetitive.

To balance it, companies often create a base cost sheet template that includes standard direct and indirect cost categories. Then, depending on the buyer or product, they adjust allocations accordingly. Some even use ERP software or costing modules to automate this for accuracy.

Being able to explain your direct cost vs indirect cost in a buyer meeting shows professionalism. It builds trust, and positions your factory or brand as cost-conscious and reliable.

Fabric Costs and Fabric Consumption in Garment Costing

How to Calculate Fabric Consumption in Garment Costing

In the costing in garment industry, one of the most sensitive and error-prone areas is fabric consumption. It’s the heart of your cost sheet, and even a 0.1% miscalculation can lead to thousands of dollars in losses or overcharging. So how do buyers and factories get it right?

Fabric consumption refers to how much fabric is required to make a garment, including allowances for shrinkage, wastage, and fabric defects. It’s typically measured in yards or meters and varies depending on fabric width, garment style, and size curve. For example, a fitted women’s blouse uses less fabric than a loose unisex hoodie, even if both are size medium.

To calculate this accurately, factories use either manual methods (like pattern measurement) or software-based techniques like CAD. You start with the fabric width (usually 44″, 58″, or 72″) and garment marker layout. Add wastage allowance (around 5-10% depending on fabric type), then multiply by the number of pieces. Complex styles, like pleated dresses or layered jackets, increase consumption. Bulk orders usually reduce per-unit wastage.

A fabric consumption chart can be a lifesaver for merchandisers. These reference tables provide average yardage needed for each product type across sizes, which speeds up rough costing during early buyer communication.

Why is this important? Because incorrect fabric consumption leads to incorrect fabric cost, which then affects total garment cost and price competitiveness. And in the fast-moving world of fashion, misquoting a buyer due to poor consumption calculations can cost you the deal.

So, when it comes to costing in garment industry, always remember: consumption isn’t guesswork, it’s math. And math, when wrong, gets very expensive.

Understanding Fabric Cost Per Yard and Total Fabric Cost

Now that you’ve estimated consumption, the next step in the costing in garment industry is calculating fabric cost per yard. This figure directly affects 40% to 70% of your total cost sheet, depending on the garment category.

Let’s say you’re sourcing 100% cotton jersey from a local supplier at $2.50/yard. If your consumption is 1.3 yards per unit including wastage, your fabric cost per garment is $3.25. But here’s where it gets tricky, suppliers may quote in kg, meters, or rolls. Conversions must be precise, especially for knitted or lightweight fabrics where shrinkage is a concern.

Also, don’t forget fabric costs include more than the base price. Add import duties, freight (especially for overseas sourcing), dyeing costs, testing fees, and sometimes even financing charges. Some suppliers offer bulk discounts if MOQ (minimum order quantity) is met, which can significantly change your cost sheet outcomes.

Factories often underestimate the role of cost of fabric in seasonal pricing. Prices fluctuate with global cotton rates, currency exchange, or supplier availability. Smart buyers stay updated on textile market trends, and smart factories lock prices early for large orders.

When creating the cost sheet garment, make sure fabric costs are broken down line by line. For instance:

- Fabric base rate

- Shrinkage buffer

- Freight charges

- Testing fees

- Total fabric cost

This breakdown improves transparency during buyer audits or vendor meetings. In some factories, there’s even a review team that only cross-verifies fabric cost per yard across all orders before confirming the FOB.

Ultimately, in the costing in garment industry, fabric cost isn’t just a number, it’s a reflection of sourcing efficiency, negotiation skills, and forecasting accuracy.

Fabric Cost and Its Share in the Costing Sheet

Fabric cost is king, no exaggeration. In nearly every costing in garment industry analysis, fabric cost is the largest contributor to the total manufacturing cost. That’s why both buyers and factories scrutinize it more than anything else in the cost sheet.

Here’s the typical structure:

If your garment retails at $25, the factory cost might be $8, and fabric cost alone could account for $3.5 to $5. That’s more than CM, trims, packaging, and even overhead combined. Why? Because fabric is both the canvas and the character of the product.

The percentage of fabric cost also depends on garment type. For a basic t-shirt, it could be 65-70%. For denim, fabric might be 50%, with heavy washing and accessories filling the rest. For jackets or fashion pieces with embellishments, it might fall below 40%. But in every case, it’s still the dominant cost.

The garment costing sheet must reflect fabric cost not just in total, but by source and fabric type. This helps factories compare domestic vs imported sourcing or cotton vs blends. It also helps buyers negotiate based on volume orders, colorways, and finishing methods.

Smart brands analyze this part of the sheet before everything else. They’ll ask: Is the fabric organic? Is it pre-shrunk? Is it compliant with OEKO-TEX or GOTS? Every “yes” adds value, but also cost. So transparency matters.

From a factory’s point of view, presenting a well-documented fabric cost shows preparedness. From a buyer’s side, it ensures that the cost sheet isn’t inflated. This level of clarity sets the tone for the rest of the negotiation.

In summary, if you want to master costing in garment industry, start with mastering fabric cost. It’s where both savings and losses hide.

Manufacturing Costing in Garment Industry – CM, Overhead & Equipment

What Is CM Cost in Garment Industry?

In the costing in garment industry, CM cost (Cut and Make) is one of the most critical figures that directly links to factory operations. It refers to the cost charged by the manufacturer for cutting the fabric and sewing it into a finished garment. Unlike fabric cost, which depends on external suppliers, CM is an internal production cost and can differ significantly between factories, even within the same country.

The CM cost meaning varies based on several variables. For instance, complexity of the garment (a basic T-shirt vs. a double-layered hoodie), production volume (bulk orders get better rates), and the location of the factory (labor rates vary from Dhaka to Ho Chi Minh City). In most Asian markets, CM charges for simple styles range between $0.30 to $1.50 per unit, while more intricate styles can go beyond $3.

Why is this important in your garment costing sheet? Because buyers don’t just pay for labor, they pay for precision, speed, and consistency. Factories with better quality control, trained operators, and streamlined workflows often charge a higher CM, and rightfully so. It guarantees fewer rejects, fewer remakes, and better timelines.

Another thing to note is the negotiation around CM. Some buyers prefer breaking it down into Cut, Sew, and Finishing separately for better understanding. Others include allowances for QC or defect ratio directly in this figure. If you’re unclear, the whole pricing conversation can derail.

In many costing discussions, CM becomes the negotiation battleground. So, having a clear, justifiable, and transparent CM figure in your costing in garment industry practices not only helps your sheet, but also helps build trust.

Overhead Costs and Manufacturing Cost Breakdown

If CM is the heart of factory pricing, then overhead costs are the lungs. They keep operations running quietly in the background, often unnoticed, but absolutely vital. In the costing in garment industry, overhead costs represent non-direct expenses required to keep the production floor functioning.

This includes electricity bills, water supply, security, internet, office rent, depreciation of sewing machines, maintenance, salaries of non-production staff, compliance certifications, and even tea for workers. While they’re not tied to a specific garment, they’re essential for every unit that rolls out.

Many factories underestimate this component. They either forget to add it or apply vague percentages. But in reality, overhead should be calculated monthly and distributed over the factory’s output volume. For example, if your monthly overhead is $20,000 and you produce 100,000 pieces per month, then overhead per unit is $0.20.

This manufacturing cost breakdown gives a more realistic picture of your real per-unit cost. And when buyers see a well-structured cost sheet with transparent overhead costs, they know you’ve done your math. It signals maturity and accountability.

Buyers also want to know if factories meet social and environmental standards. Certifications like WRAP, BSCI, or GOTS come with audit fees and improvements that raise overhead. That’s okay, as long as it’s shown clearly. Transparency creates confidence.

So if you’re compiling your costing in garment industry templates, make room for detailed cost breakdown. It may feel like extra work, but it’s what separates average factories from strategic partners.

Role of Sewing Machine Cost and Repair in Costing

Let’s get real, machines don’t last forever. In any costing in garment industry analysis, the sewing machine cost is a long-term investment, but repairs and maintenance? That’s a monthly headache. Still, both need to be considered when calculating real manufacturing cost.

Let’s say a factory spends $20,000 on industrial sewing machines and amortizes them over five years. That’s $333 per month. Add to that periodic repairs, technician costs, and oil changes, your monthly sewing machine repair cost could add another $200–$500. Divide that by your monthly production output, and you’ll get the per-piece machine cost allocation.

Most factories ignore this. They lump it under overhead or don’t track it at all. But smart manufacturers, especially those who produce high volumes, use machine tracking tools to forecast repair cycles and costs. They also factor in machine downtime, because every idle machine costs money, even if it isn’t being repaired.

In high-end fashion or technical garments, specialized machines (like flatlock, bar tack, or fusing) increase capital cost significantly. Buyers are often unaware of these details, but mentioning them during cost discussions builds credibility. For instance, a factory that invested in automatic laser cutters can command higher CM costs with ease, because they save time and improve finish quality.

The costing in garment industry is not just about inputs; it’s also about infrastructure. And infrastructure needs maintenance. Including sewing machine cost and its upkeep in your cost structure reflects a mature, future-focused mindset.

In short, if you want to stay competitive, treat your machines not just as tools, but as cost centers. Track them, maintain them, and reflect them transparently in your costing.

FOB Price and Profit Margin in Garment Costing

Understanding FOB Price in the Garment Industry

If you’ve been in sourcing or manufacturing for even a short while, the term FOB price has definitely come up. In the costing in garment industry, this is one of the most commonly used pricing terms, but surprisingly, it’s also one of the most misunderstood.

FOB stands for “Free On Board.” In simpler terms, FOB price refers to the total cost of the product up to the point it’s loaded onto the ship at the port of departure, usually the seller’s port. It includes everything: fabric, trims, CM, overhead, profit, packing, testing, documentation, inland transportation to the port, and loading. But it doesn’t include freight, insurance, or unloading at the buyer’s destination.

When buyers ask for the FOB price meaning, they’re not just asking for a number. They’re asking for what that number includes. If a factory gives an FOB quote of $6 for a shirt, a buyer might ask: “Does that include hangers? What about polybags? Are wash care labels and testing part of it?”

Many misunderstand what is FOB price and confuse it with CIF (Cost, Insurance, Freight) or EXW (Ex Works). That’s why it’s vital for both buyers and suppliers to align their terminology. For example, what is FOB price in clothing? It’s the landed cost of a ready-to-ship garment, excluding the logistics beyond the port.

When included properly in the garment costing sheet, the FOB gives a clear, full picture of all cost components and margin. For buyers, it’s a starting point for total landed cost calculation. For factories, it’s their offer price, and a line they need to protect to maintain profits.

In short, the FOB price is more than a shipping term. It’s the final number on your costing in garment industry checklist before the order is confirmed.

Calculating Profit Margin in Garment Costing

Let’s be honest, profit margin is what everyone ultimately cares about in the costing in garment industry. No matter how detailed your cost sheet is, if your margin isn’t healthy, your business won’t last. And yet, so many companies treat this as a mystery number instead of a strategic choice.

A profit margin is simply the difference between your FOB cost and your internal cost of production. If your total cost is $4.80 and you quote $6.00, your margin is $1.20 per unit, or 25%. The magic lies in how you calculate that $4.80.

Here’s the mistake many new factories make: they only account for fabric and CM, ignoring hidden costs like courier, sampling, testing, and late delivery penalties. These add up and eat away your margin silently.

What’s a healthy profit margin in the garment world? It depends. In Bangladesh, a margin of 12–20% is considered good for large-volume basic items. For smaller runs or fashion items, 25–35% might be targeted. Premium brands often go higher, but with higher risk.

Now, buyers also care about cost breakdown. If a supplier says, “My margin is 30%,” buyers might push back, unless you can justify it. A transparent cost breakdown in the cost sheet that shows each component gives the buyer confidence that they’re paying a fair price.

Margin also affects negotiations. If a factory has only 8% margin, there’s no room for discounts. If they have 25%, they can absorb price drops, urgent sampling, or last-minute spec changes. That’s why managing and presenting your profit margin clearly isn’t just about money, it’s about leverage.

So next time you prepare your garment costing sheet, don’t treat margin as a leftover. Build it intentionally, defend it confidently, and track it carefully.

Using Cost Sheet for Order Quotes and Buyer Deals

Once all the numbers are calculated, the fabric cost, CM, overhead, trims, and margin, the final job is preparing a quote. And this is where the cost sheet becomes your most powerful tool.

An order quote isn’t just a number, it’s a signal to the buyer that you understand your product, your pricing, and your profit. That’s why the quotes on order must always align with the latest cost sheet. If your quote includes outdated rates, incorrect yardage, or missing add-ons, you risk appearing unprofessional, or worse, losing the order.

Buyers often request multiple quotes for different quantities, colors, or delivery windows. Your cost sheet should be flexible enough to generate quick variations. For example, quoting for 5,000 pieces vs. 20,000 pieces will change per-unit costs because of volume discounts, especially in fabric cost and CM.

The best suppliers create dynamic cost sheet templates that auto-update quotes based on changes in fabric price or delivery mode. This is especially useful when currency fluctuations, fabric shortages, or seasonal surcharges come into play.

More importantly, using the cost sheet in order negotiations gives you strength. If a buyer asks for a discount, you can show them a cost breakdown and ask, “Where exactly would you like the reduction, fabric, trims, or CM?” This changes the conversation from discount demand to collaborative adjustment.

In the costing in garment industry, a well-structured cost sheet is not just documentation, it’s a selling tool, a trust builder, and a negotiation map.

RYZEAL’s Thoughts on Costing in Garment Industry

At RYZEAL SOURCING, we believe that transparency is the future of global sourcing. As a company deeply involved in manufacturing coordination and buyer support, we’ve seen firsthand how a detailed, fair, and well-documented garment costing sheet leads to stronger partnerships.

Our clients don’t just want low prices, they want justifiable prices. They want to see how costs break down, where savings can be made, and what innovations we’re using to improve margins. Whether it’s through sustainable fabric sourcing, optimized CM processes, or digitized cost sheet systems, we guide both buyers and factories toward smarter decisions.

If you’re tired of vague quotes and inconsistent pricing, maybe it’s time to switch to a partner who values structure, clarity, and collaboration.

Let’s Develop Your Garment Costing Strategy with RYZEAL SOURCING

Explore our sourcing solutions, factory coordination services, and knowledge-driven blog articles to learn more. At RYZEAL, we don’t just calculate costs, we create value.